A low-volatility, diversified ETF portfolio with consistent outperformance

Investors often face a trade-off: accept market volatility for potential gains, or sacrifice returns for stability. Our flagship low-volatility ETF portfolio is designed to challenge that dichotomy.

By applying disciplined, research-driven principles to ETF selection and allocation, this strategy seeks to deliver competitive long-term performance with a markedly smoother journey.

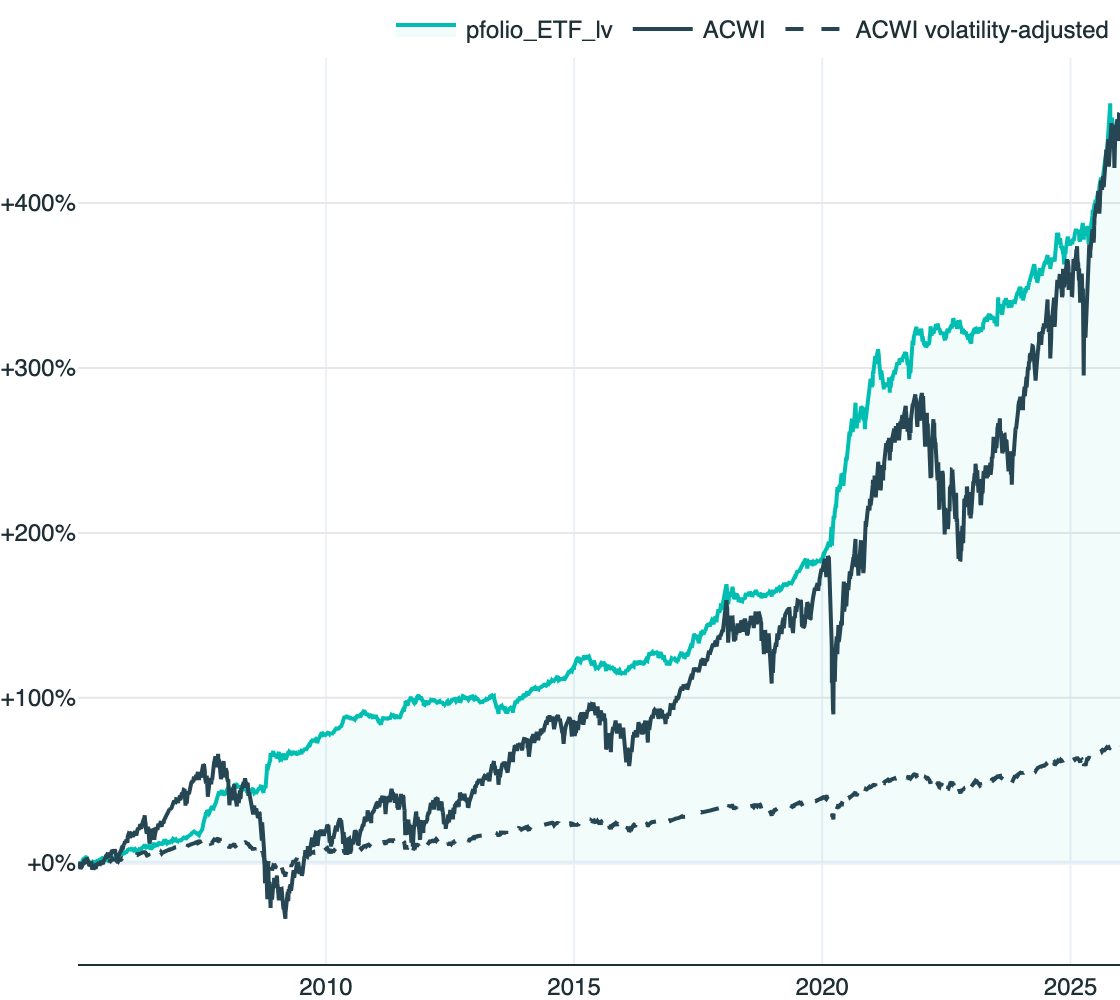

Portfolio returns

The following chart illustrates the cumulative returns of the portfolio against the MSCI All Country World Index (total return). To facilitate a direct risk-adjusted comparison, we also display a volatility-scaled version of the benchmark, adjusted to match the portfolio's risk level.

Portfolio performance statistics

The portfolio's long-term performance is summarised by the following key statistics over the 21-year period:

For methodological details on these calculations, please refer to this article. Live, daily-updated statistics are available here, and comprehensive historical data, including full allocation history, can be accessed in the pfolio app.

The following sections detail the construction methodology for the low-volatility ETF portfolio. We begin by outlining our core portfolio building framework—firmly grounded in academic investing principles—then explain the practical application through specific asset selection and allocation.

A principled portfolio framework

The foundation of our portfolio construction is a three-pillar framework designed to be diversified, systematic, and adaptive. Each principle is grounded in academic research and serves a specific purpose in building robust, long-term strategies.

1. Diversification: Reducing risk through correlation

The cornerstone of Modern Portfolio Theory originates from Harry Markowitz's seminal 1952 work, Portfolio Selection.

His key insight demonstrates that by combining assets with imperfect correlations, investors can construct portfolios that achieve superior risk-adjusted returns.

We apply this principle through strategic allocation across non-correlated assets to minimise overall portfolio volatility without sacrificing return potential.

2. Systematic implementation: Mitigating behavioural bias

Empirical research strongly suggests that rule-based, systematic strategies can help mitigate the performance-damaging effects of behavioural bias inherent in discretionary approaches.

For the DIY investor, this emotional strain often manifests as performance-detrimental behaviours like panic selling or performance chasing.

This challenge is well-documented. Barber and Odean (2000), in their seminal study of individual investor trading, found that excessive trading—often driven by overconfidence and attention-driven buying—significantly reduced net returns.

Our framework directly addresses this by replacing emotional, reactive decision-making with disciplined, repeatable rules designed to enforce consistency and remove discretion at the point of potential bias.

3. Adaptive allocations: Responding to market regimes

Fixed allocations can lead to extended periods of underperformance, as asset classes often experience prolonged cycles.

We incorporate the well-documented time-series momentum factor (Moskowitz, Ooi & Pedersen, 2012) to allow portfolios to adapt to changing market conditions.

This dynamic approach helps avoid prolonged exposure to depreciating assets while maintaining participation in positive trends.

From principles to implementation

Our three core principles—diversification, systematic rules, and adaptive allocations—are applied through a structured two-phase process.

This approach separates high-level portfolio design (establishing the strategic blueprint) from ongoing portfolio construction (executing—generally monthly—allocations).

The following section illustrates this process using our low-volatility ETF portfolio as a concrete example. For a comprehensive, step-by-step explanation of our methodology, please refer to our detailed guide.

Putting the framework into practice

The full portfolio configuration can be found in the pfolio app (Portfolios Overview > select pfolio_ETF_lv > click Actions, then View Details).

From this interface, you can also create a modifiable copy of the portfolio to serve as a foundation for your own custom strategy.

1. Portfolio setup

In this initial setup, we set basic portfolio parameters, like name and currency. The portfolio name uniquely identifies the portfolio across the platform.

2. Asset selection

This step defines the universe of assets from which the portfolio can be built. It is important to select a diverse set of assets to enable the construction of a truly diversified portfolio.

The selection should also directly reflect your investment mandate—for example, limiting the universe to ETFs versus including individual stocks, or focusing on developed markets versus a global scope.

Note that the portfolio's final allocation may not include all selected assets; this initial list simply sets the available opportunity set.

Our low-volatility ETF portfolio is constructed from a diversified universe of funds spanning multiple geographies and asset classes. The eligible ETFs are listed below, grouped by asset class:

- IVV, iShares Core S&P 500 ETF: Broad exposure to the large-cap US equity market

- QQQ, Invesco QQQ Trust: Targeted exposure to the US technology sector, as represented by the NASDAQ-100 Index

- EFA, iShares MSCI EAFE ETF: Exposure to developed equity markets outside of the US and Canada

- EEM, iShares MSCI Emerging Markets ETF: Exposure to equity markets in emerging economies

- ARKK, ARK Innovation ETF: Thematic exposure to disruptive innovation and next-generation technologies

- BND, Vanguard Total Bond Market Index Fund: Broad exposure to the US investment-grade bond market

- BNDX, Vanguard Total International Bond Index Fund: Exposure to investment-grade bonds issued in foreign currencies, hedged to USD

- IEF, iShares 7-10 Year Treasury Bond ETF: Targeted exposure to intermediate-term US Treasury bonds

- TLT, iShares 20+ Year Treasury Bond ETF: Focused exposure to long-term US Treasury bonds

- LQD, iShares iBoxx $ Investment Grade Corporate Bond ETF: Exposure to US-dollar-denominated investment-grade corporate bonds

- LTPZ, PIMCO 15+ Year U.S. TIPS Index Exchange-Traded Fund: Exposure to long-term US Treasury Inflation-Protected Securities (TIPS)

- MBB, iShares MBS ETF: Exposure to the US agency mortgage-backed securities (MBS) market

- GLD, SPDR Gold Shares: Exposure to physical gold, often used as a strategic hedge and diversifier against inflation and equity market stress

- UUP, Invesco DB US Dollar Index Bullish Fund: Exposure to the performance of the US dollar against a basket of major world currencies

- VIXM, ProShares VIX Mid-Term Futures ETF: Exposure to mid-term S&P-500 volatility expectations, primarily used as a tactical hedge against significant market downturns and spikes in fear (the VIX)

The correlation matrix below illustrates the diversity of return streams available in the portfolio's asset selection.

As anticipated, correlations are high within asset classes (e.g., between equity ETFs) and low to negative between different asset classes (e.g., equities vs. bonds vs. gold).

The benchmark (ACWI) is included for reference but is not part of the asset universe. The '_e' suffix denotes assets where extended historical data (e.g., futures) has been used for backfilling.

3. Asset allocation

The allocation process is performed monthly to translate the strategic asset selection into an actionable portfolio.

This involves two specific decisions: selecting the active subset of assets from the eligible universe and determining the precise weight for each included asset.

The resulting allocations define the portfolio's positions for the upcoming month.

Asset subset selection

The conceptual goal of the asset subset selection is to identify assets with a higher probability of positive near-term returns.

To this end, we apply the time-series momentum factor (Moskowitz, Ooi & Pedersen, 2012), which uses recent price performance as a systematic signal for future inclusion.

Asset weight calculation

The conceptual goal of the asset weight calculation is to optimise the risk-return profile of the selected subset.

We achieve this through a monthly portfolio optimisation that synthesises the foundational mean-variance framework of Markowitz (1952) with the dynamic volatility targeting principles of Moreira and Muir (2017).

Putting it all together

The construction process is summarised below. For the sake of clarity, this overview abstracts away many nuanced implementation settings, which can be viewed in the pfolio app.

Our portfolio integrates two distinct components for improved risk management: a performance portfolio, designed to capture return, and a hedge portfolio, designed to mitigate risk. The final allocation is a strategic combination of these two.

The performance portfolio is built in two steps: (1) selecting the seven best risk-adjusted performers from the 15 eligible assets over a 12-month lookback, and (2) determining their weights via mean-variance optimisation.

This optimisation uses a ~five-month historical window for return and covariance estimation, with the covariance matrix regularised using the Ledoit and Wolf (2003) shrinkage estimator.

The hedge portfolio is constructed by selecting three assets from the remaining universe that demonstrated both high risk-adjusted performance and low correlation to the performance portfolio over the preceding six-month period.

We then perform a second mean-variance optimisation to determine the optimal allocation between the combined performance portfolio and the hedge portfolio. This entire two-layer process is repeated monthly to generate new target weights.

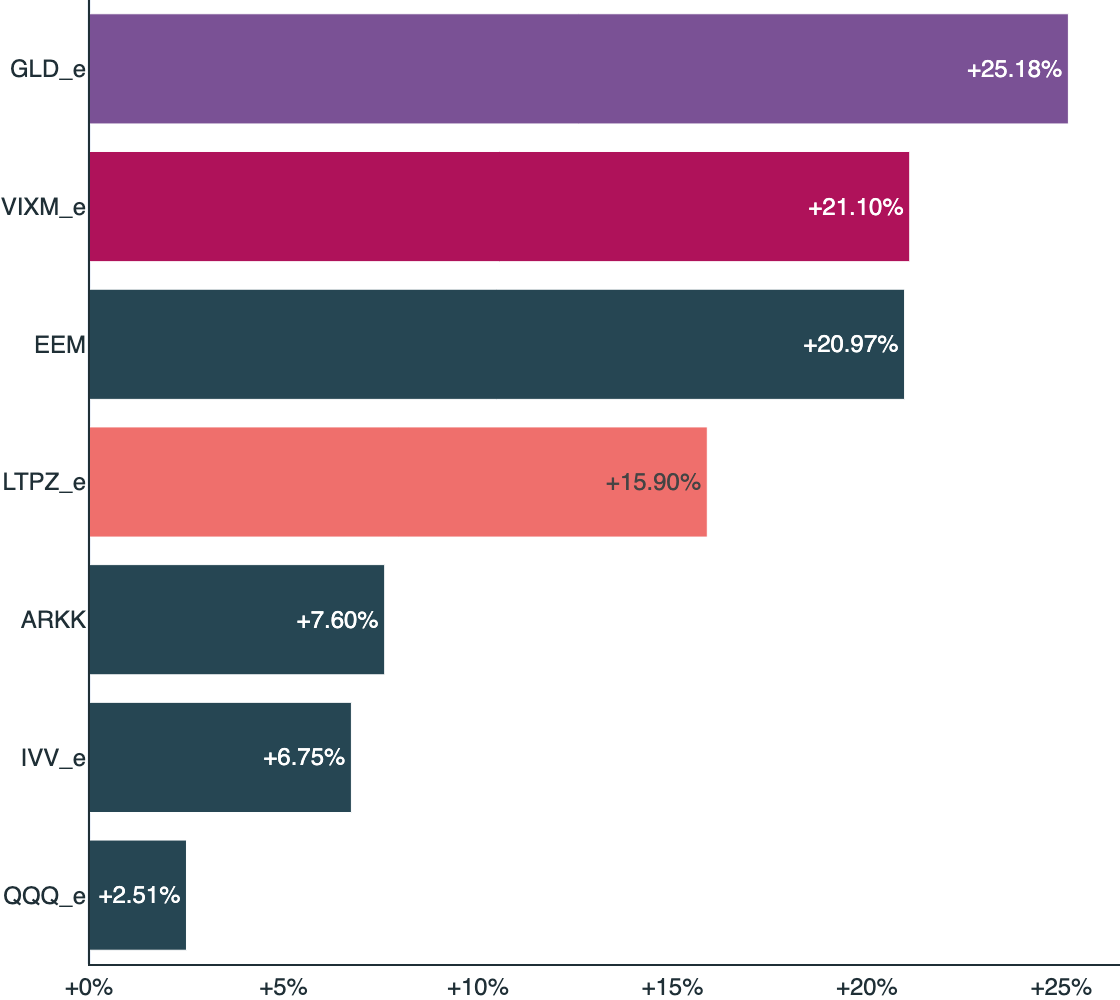

The chart above illustrates the resulting portfolio allocation, using the target weights for October 2025 as a representative example.

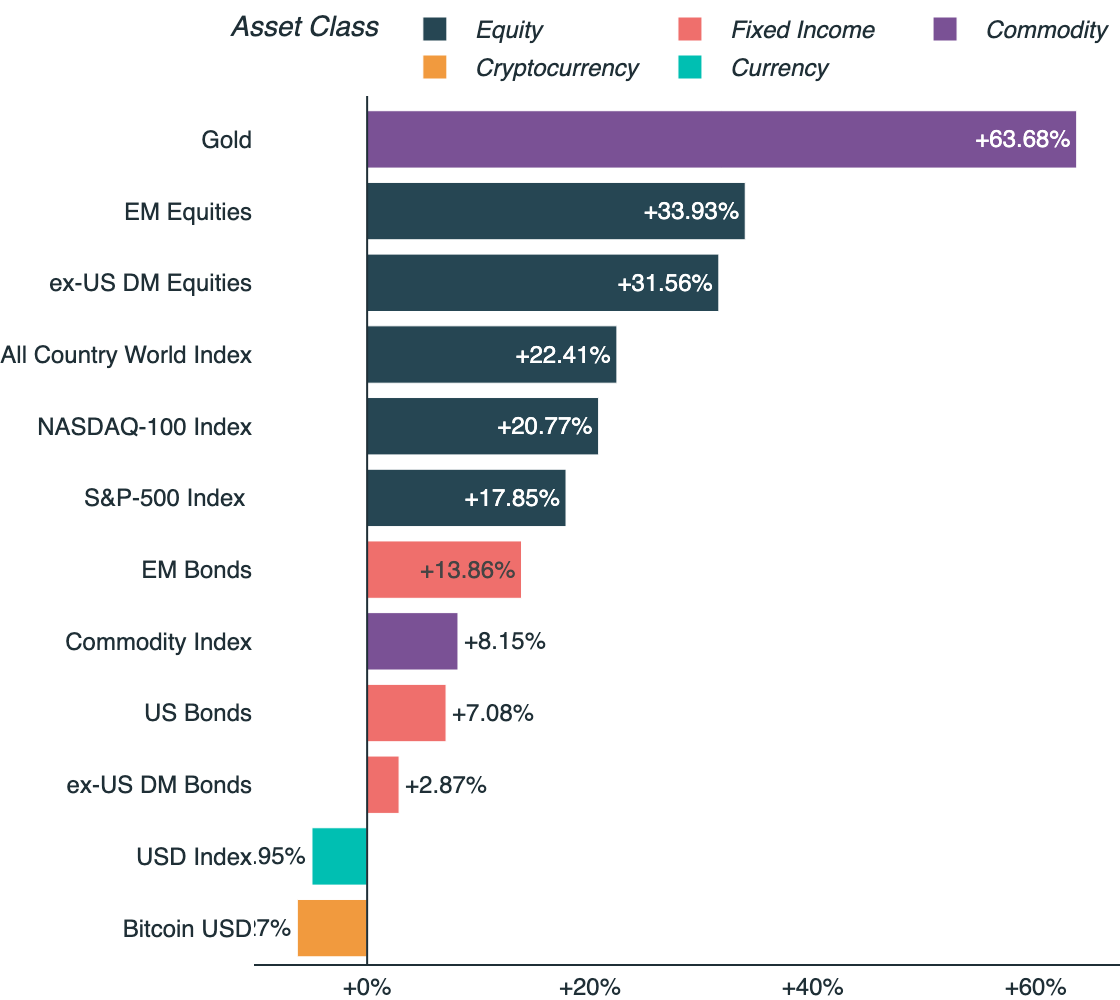

Portfolio analysis beyond returns

While the key portfolio statistics were presented earlier, the following section offers additional analytical perspectives on its performance.

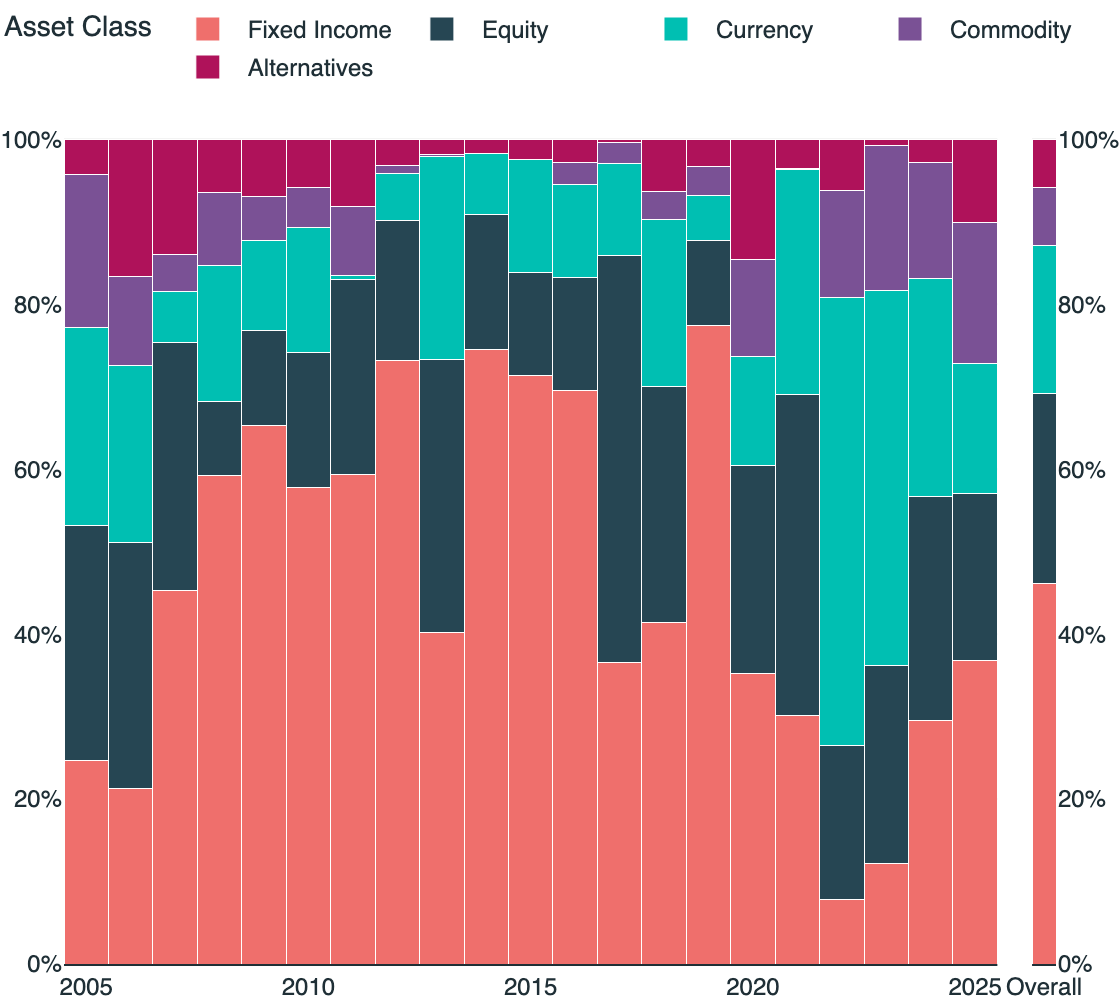

Dynamic, adaptive allocations

The historical asset class allocation chart illustrates the portfolio's dynamic adaptation to changing regimes.

A clear example is its tactical reduction of fixed income exposure during the period of historically low interest rates (2019–2022), followed by a measured increase, as monetary policy shifted toward tightening.

Structural hedging to smooth ride during market stress

During the COVID-19-induced equity market crash in early 2020, major indices fell over 30% in a matter of weeks.

Due to its intrinsic diversification and always-on hedging logic, the portfolio experienced no significant drawdowns during this episode and outperformed the broader market in absolute terms.

Such episodes are particularly challenging for concentrated or equity-only investors and can trigger detrimental behaviours like panic selling.

Investors with shorter time horizons (e.g., those near retirement or those planning major investments, like buying a house) may not have the flexibility to wait for a full market recovery, making capital preservation during downturns a critical component of a long-term strategy.

Both concepts—adaptive allocations and systematic risk management—are embedded within the core portfolio construction framework. This design requires no specific intervention from the investor during periods of market turbulence, as the rules-based process automatically adjusts exposures and manages risk according to its predefined logic.

How to invest in the low-volatility ETF portfolio

With just a few clicks, you can implement this low-volatility ETF strategy—or any portfolio on our platform.

Providing DIY investors with simplified access to professional-grade tools and systematically managed portfolios is the core mission behind pfolio.

- Access the target allocations and specific trading instructions via the pfolio app.

- Execute the trades directly through your own brokerage account.

Access to the pfolio app requires a subscription. You can explore all features risk-free with a one-month trial, no commitment required.

For step-by-step guidance on investing, rebalancing, and analysing portfolios, visit our comprehensive Help Centre.

Literature

Barber, B. M., & Odean, T. (2000). Trading is hazardous to your wealth: The common stock investment performance of individual investors. The Journal of Finance, 55(2), 773–806.

Ledoit, O., & Wolf, M. (2003). Honey, I shrunk the sample covariance matrix. The Journal of Portfolio Management, 30(4), 110–119.

Markowitz, H. (1952). Portfolio selection. The Journal of Finance, 7(1), 77–91.

Moreira, A., & Muir, T. (2017). Volatility-managed portfolios. The Journal of Finance, 72(4), 1611–1644.

Moskowitz, T. J., Ooi, Y. H., & Pedersen, L. H. (2012). Time series momentum. Journal of Financial Economics, 104(2), 228–250.

Disclaimer

Continue Reading

Get started now