Definitions and explanations

Our performance updates provide an overview of the state of the markets across different dimensions, as well as an update on the performance and allocations of our portfolios.

Performance updates are published as follows:

Via email

- Monthly, on the last trading day of the month

- Annually, on the last trading day of the year

- Monthly, after the last trading day of the month (for example here)

- Annually, the last trading day of the year

- Up-to-date month-to-date numbers (here)

- Up-to-date year-to-date numbers (here)

Below are the definitions and explanations of the different sections covered in our performance updates.

All assets used are available in the pfolio app for further analysis.

Summary

- Category: Top performer vs. bottom performer vs. (if available) index

- Countries: Top Korea, Republic of +18.45% vs. Bottom Norway -5.34% vs. All Country World Index +1.78%

Breaking down equity markets by country, South Korea had the highest cumulative return for the given timeframe, Norway the lowest vs. the return of the selected index, the All Country World Index.

Markets

Highlights the performance of financial markets, broken down by category.

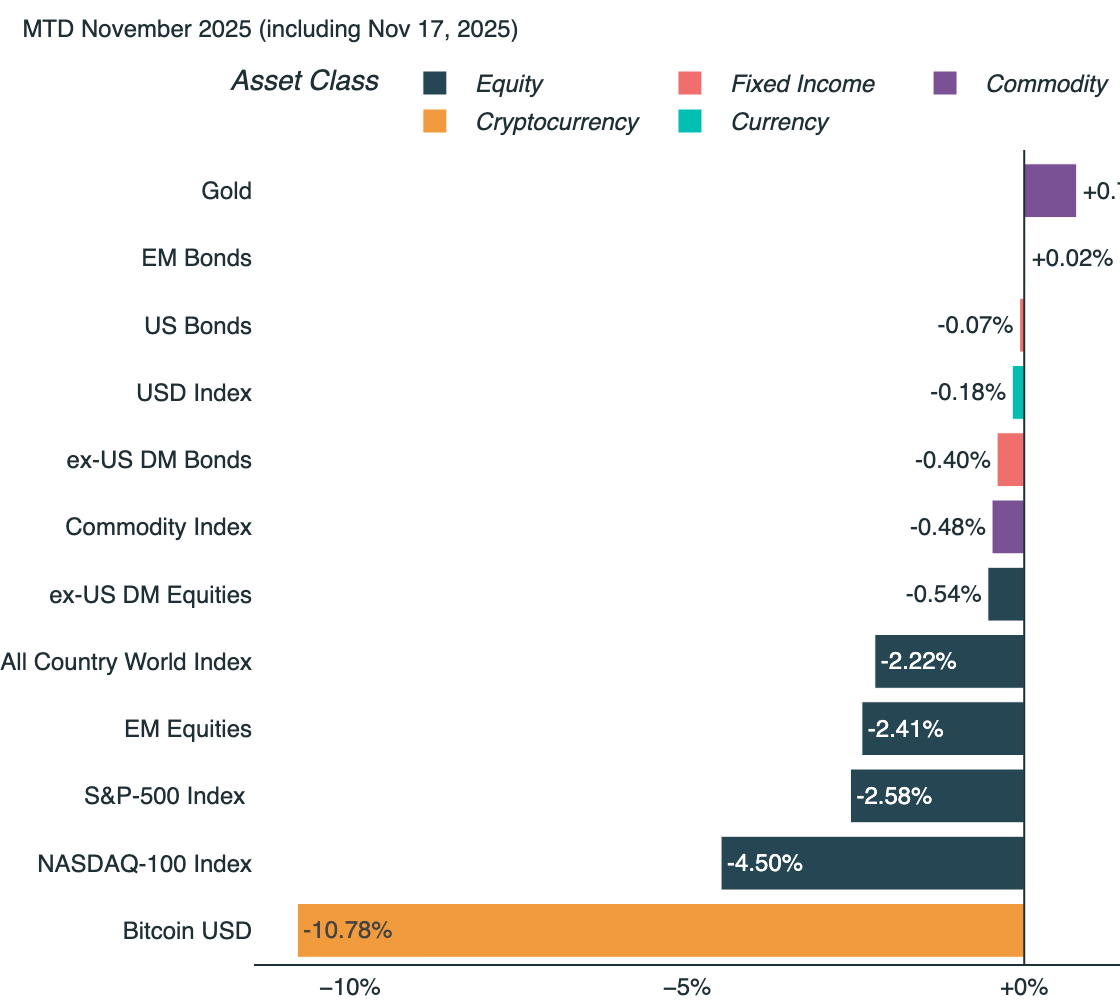

Asset classes

Reports the cumulative return over the relevant timeframe of different asset classes. The cumulative return for a month is the price on the last day of the month divided by the price on the first day of the month minus 1.

The following tickers (mostly ETFs) are used to represent different asset classes:

- Commodity Index: DBC, Invesco DB Commodity Index Tracking Fund

- Gold: GLD, SPDR Gold Shares

- Bitcoin USD: BTCUSD

- USD Index: UUP, Invesco DB US Dollar Index Bullish Fund

- All Country World Index: ACWI, iShares MSCI ACWI ETF

- Emerging Markets Equities: EEM, iShares MSCI Emerging Markets ETF

- ex-US Developed Markets Equities: EFA, iShares MSCI EAFE ETF

- NASDAQ-100 Index: QQQ, Invesco QQQ Trust

- S&P-500 Index: iShares Core S&P 500 ETF

- Emerging Markets Bonds: EMB, iShares J.P. Morgan USD Emerging Markets Bond ETF

- ex-US Developed Markets Bonds: BNDX, Vanguard Total International Bond Index Fund

- US Bonds: BND, Vanguard Total Bond Market Index Fund

The list of assets mostly overlaps with the pfolio asset list Broad Category ETFs.

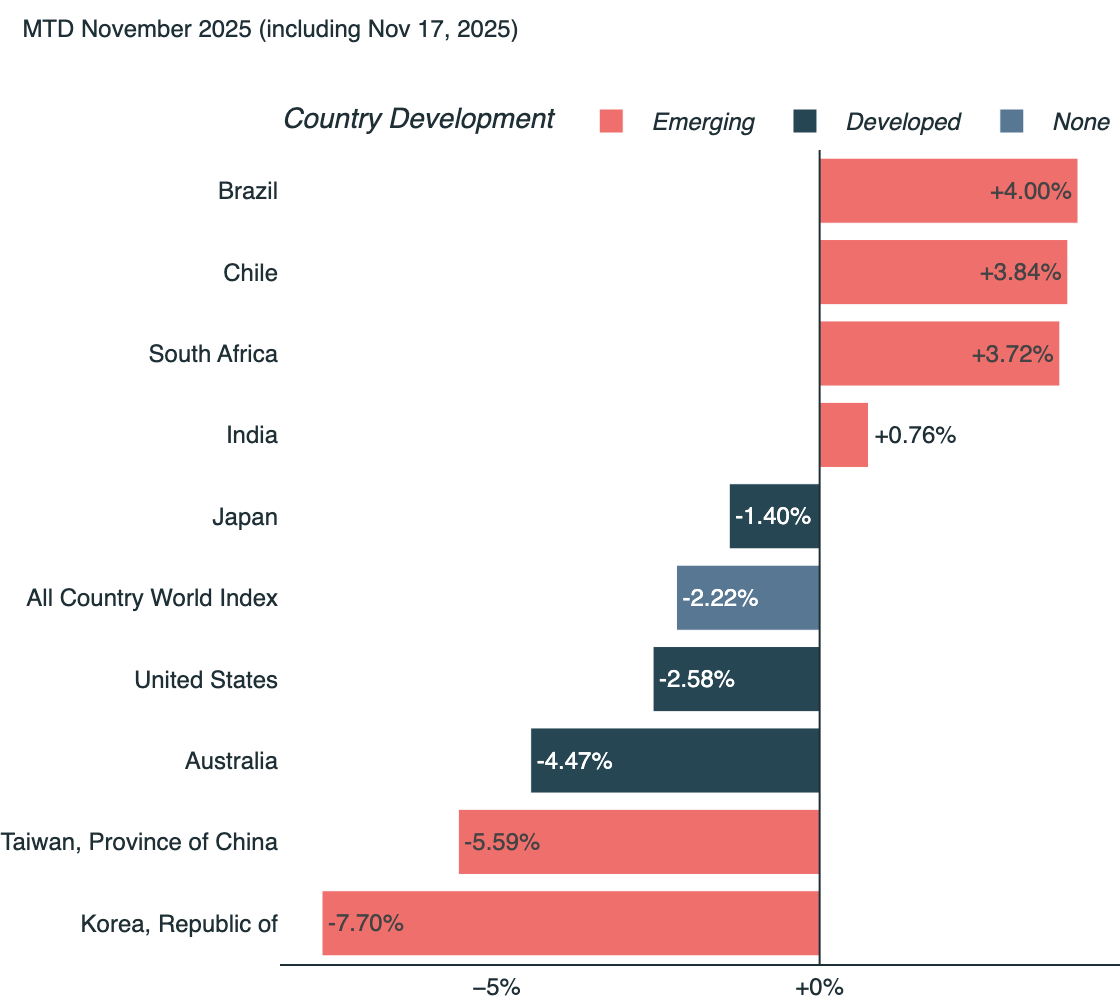

Country equity markets

Reports the cumulative return over the relevant timeframe of different country equity markets against the All World Country Index (ACWI, iShares MSCI ACWI ETF).

- Australia: EWA, iShares MSCI Australia ETF

- Austria: EWO, iShares MSCI Austria ETF

- Belgium: EWK, iShares MSCI Belgium ETF

- Brazil: EWZ, iShares MSCI Brazil ETF

- Canada: EWC, iShares MSCI Canada ETF

- Chile: ECH, iShares MSCI Chile ETF

- China: MCHI, iShares MSCI China ETF

- Denmark: EDEN, iShares MSCI Denmark ETF

- Finland: EFNL, iShares MSCI Finland ETF

- France: EWQ, iShares MSCI France ETF

- Germany: EWG, iShares MSCI Germany ETF

- Hong Kong: EWH, iShares MSCI Hong Kong ETF

- India: INDA, iShares MSCI India ETF

- Indonesia: EIDO, iShares MSCI Indonesia ETF

- Ireland: EIRL, iShares MSCI Ireland ETF

- Israel: EIS, iShares MSCI Israel ETF

- Italy: EWI, iShares MSCI Italy ETF

- Japan: EWJ, iShares MSCI Japan ETF

- Korea, Republic of: EWY, iShares MSCI South Korea ETF

- Kuwait: KWT, iShares MSCI Kuwait ETF

- Malaysia: EWM, iShares MSCI Malaysia ETF

- Mexico: EWW, iShares MSCI Mexico ETF

- Netherlands: EWN, iShares MSCI Netherlands ETF

- New Zealand: ENZL, iShares MSCI New Zealand ETF

- Norway: ENOR, iShares MSCI Norway ETF

- Peru: EPU, iShares MSCI Peru ETF

- Philippines: EPHE, iShares MSCI Philippines ETF

- Poland: EPOL, iShares MSCI Poland ETF

- Qatar: QAT, iShares MSCI Qatar ETF

- Saudi Arabia: KSA, iShares MSCI Saudi Arabia ETF

- Singapore: EWS, iShares MSCI Singapore ETF

- South Africa: EZA, iShares MSCI South Africa ETF

- Spain: EWP, iShares MSCI Spain ETF

- Sweden: EWD, iShares MSCI Sweden ETF

- Switzerland: EWL, iShares MSCI Switzerland ETF

- Taiwan, Province of China: EWT, iShares MSCI Taiwan ETF

- Thailand: THD, iShares MSCI Thailand ETF

- Türkiye: TUR, iShares MSCI Turkey ETF

- United Arab Emirates: UAE, iShares MSCI UAE ETF

- United Kingdom: EWU, iShares MSCI United Kingdom ETF

- United States: IVV, iShares Core S&P 500 ETF

The list of assets is taken from the pfolio asset list Country ETFs.

To keep the chart readable, only a selection of countries is shown. The top 3 and bottom 3 countries by cumulative return are shown, as well as the top 3 countries by market cap of the respective ETF.

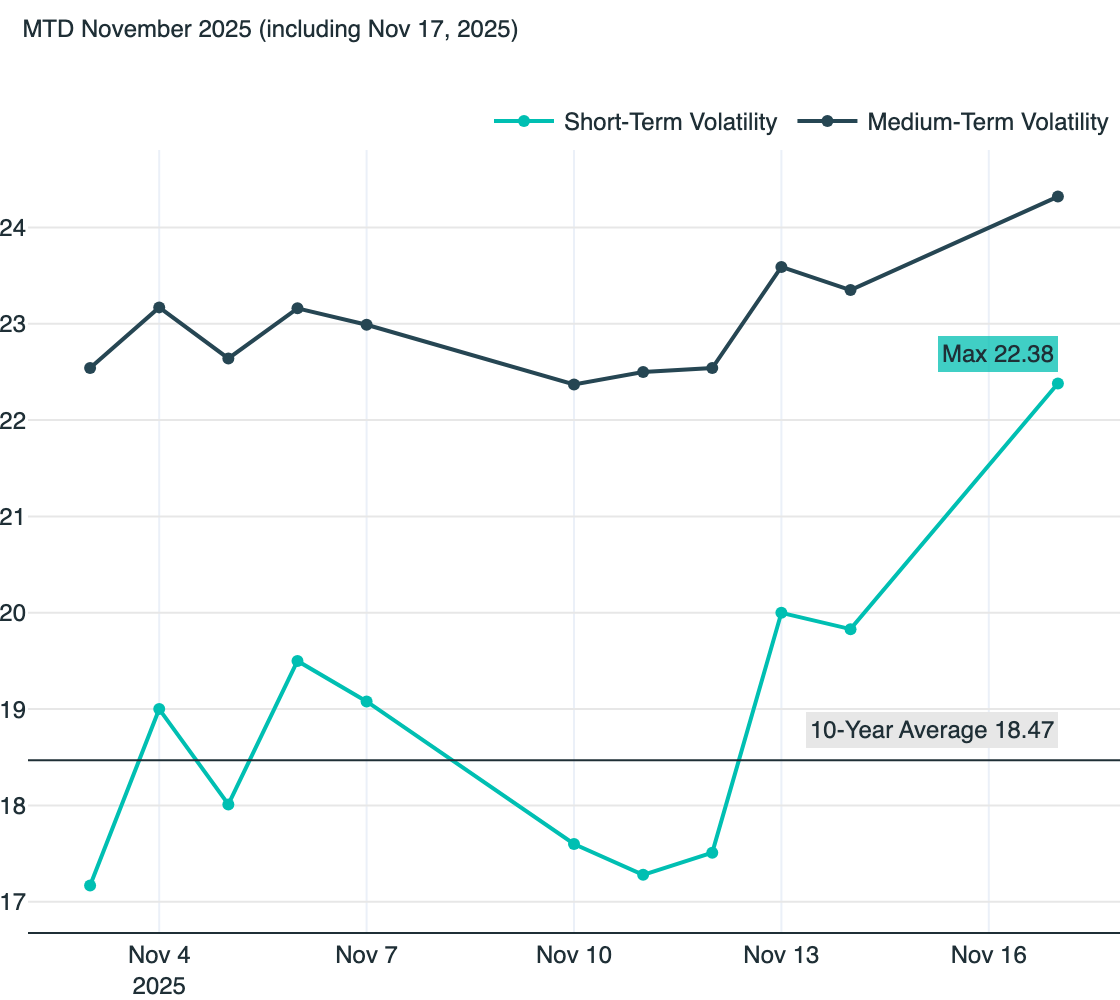

Volatility

- Short-Term Volatility: VIX, CBOE Volatility Index

- Medium-Term Volatility: VIX6M, CBOE 6-Month Volatility Index

- 10-Year Average Volatility: 10-year average VIX value

VIX measures 30-day expected volatility of the S&P-500 Index, i.e. a VIX of 15 indicates an expected annualised volatility of 15% over the next 30 days. VIX6M measures the expected volatility of the S&P-500 Index in 6 months' time. The VIX is typically in a state of contango, meanings higher medium-term volatility than short-term volatility.

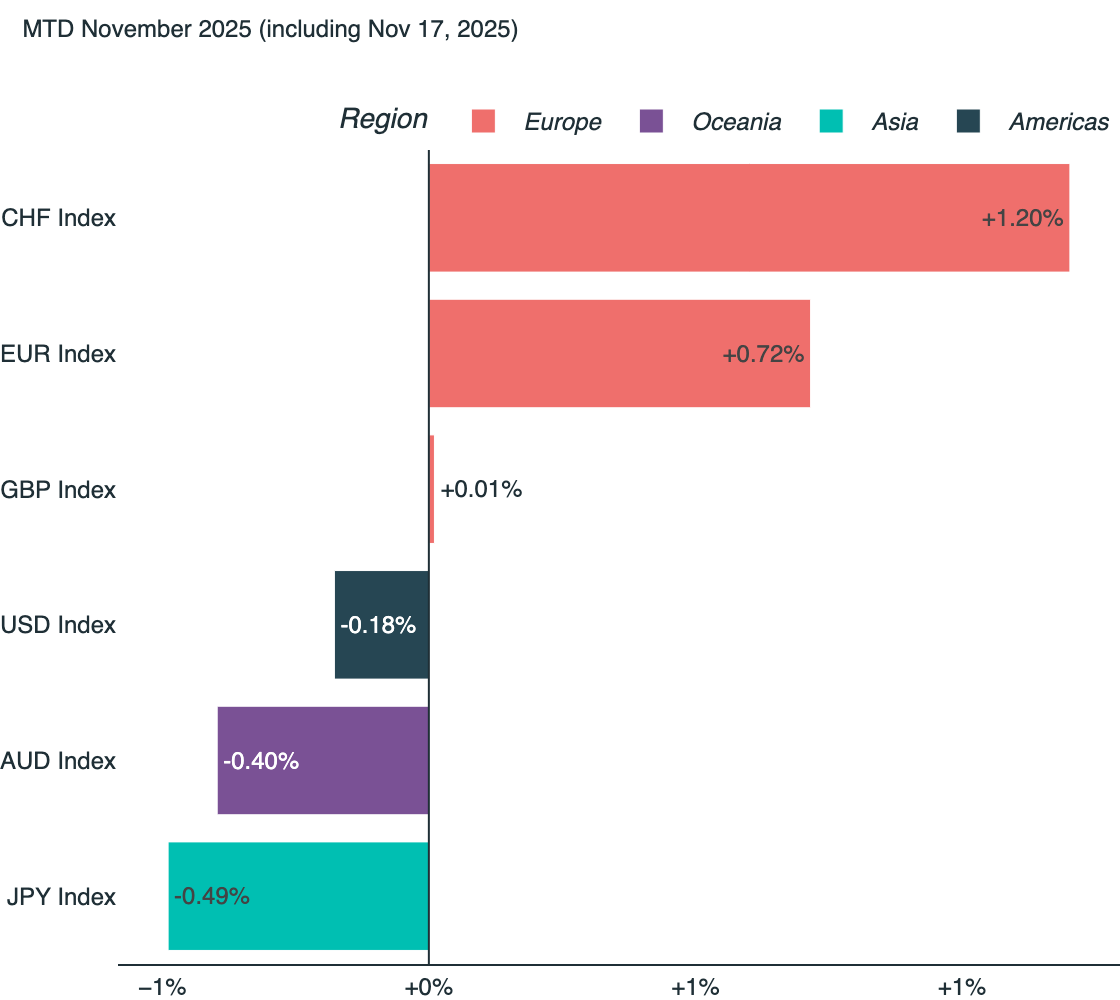

Currencies

Reports the cumulative return over the relevant timeframe of major currencies against each other.

- USD: US Dollar (weight 100%)

- EUR: Euro (weight 33%)

- JPY: Japanese Yen (weight 19%)

- GBP: British Pound (weight 11%)

- CHF: Swiss Franc (weight 7%)

- AUD: Australian Dollar (weight 7%)

The performance of the USD is measured based on UUP, Invesco DB US Dollar Index Bullish Fund, which holds US Dollar Index Futures (DX).

As no comparable index exists for the other currencies, the performance of the currency is calculated based on the weighted average value of the currency against the other currencies.

The weights are based on OTC Foreign Exchange Turnover as reported by the Bank of International Settlements in their April 2025 Triennial Central Bank Survey.

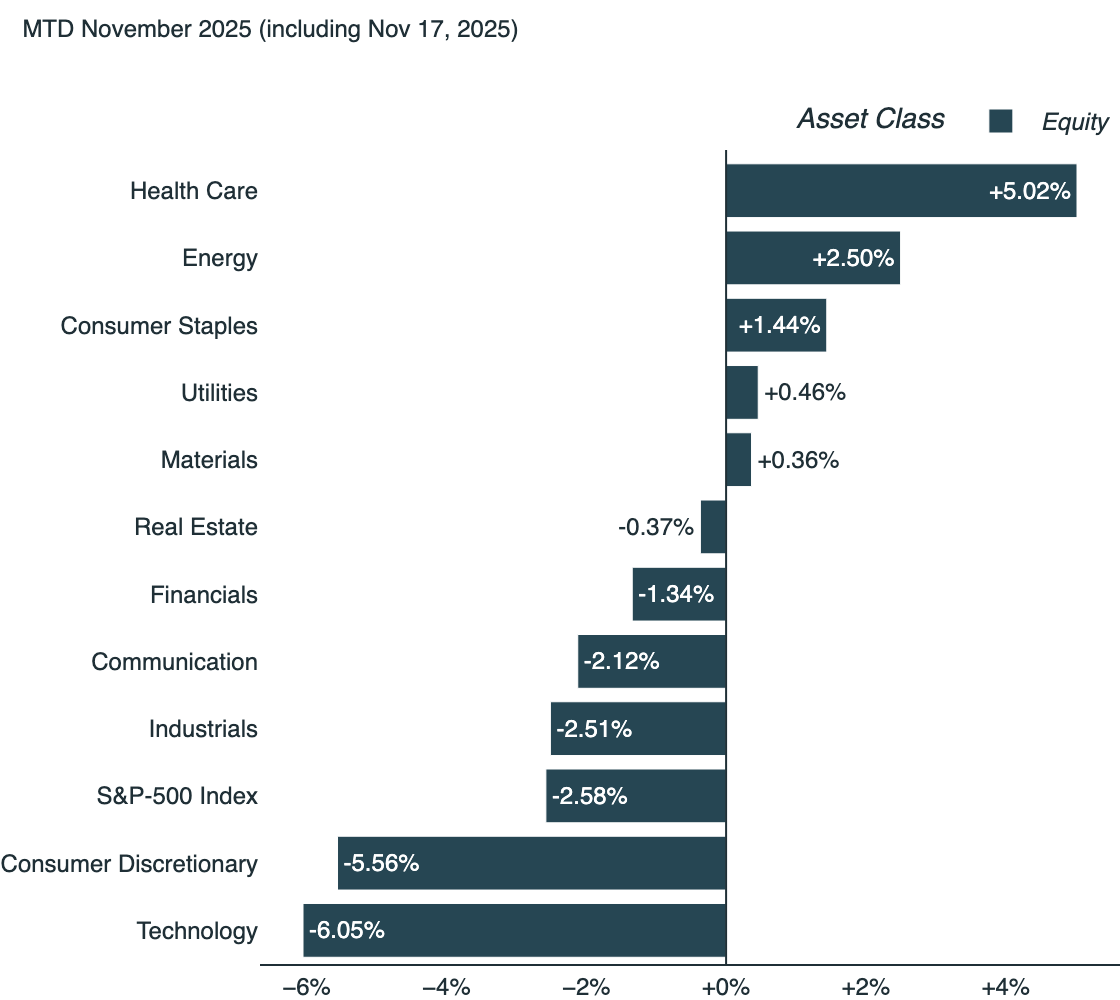

US sectors

Reports the cumulative return over the relevant timeframe of the different sectors of the S&P-500 Index against the S&P-500 Index (IVV, iShares Core S&P 500 ETF).

- Communication: XLC, The Communication Services Select Sector SPDR ETF Fund

- Consumer Discretionary: XLY, The Consumer Discretionary Select Sector SPDR Fund

- Consumer Staples: XLP, The Consumer Staples Select Sector SPDR Fund

- Energy: XLE, The Energy Select Sector SPDR Fund

- Financials: XLF, The Financial Select Sector SPDR Fund

- Health Care: XLV, The Health Care Select Sector SPDR Fund

- Industrials: XLI, The Industrial Select Sector SPDR Fund

- Materials: XLB, The Materials Select Sector SPDR Fund

- Real Estate: XLRE, The Real Estate Select Sector SPDR Fund

- Technology: XLK, The Technology Select Sector SPDR Fund

- Utilities: XLU, The Utilities Select Sector SPDR Fund

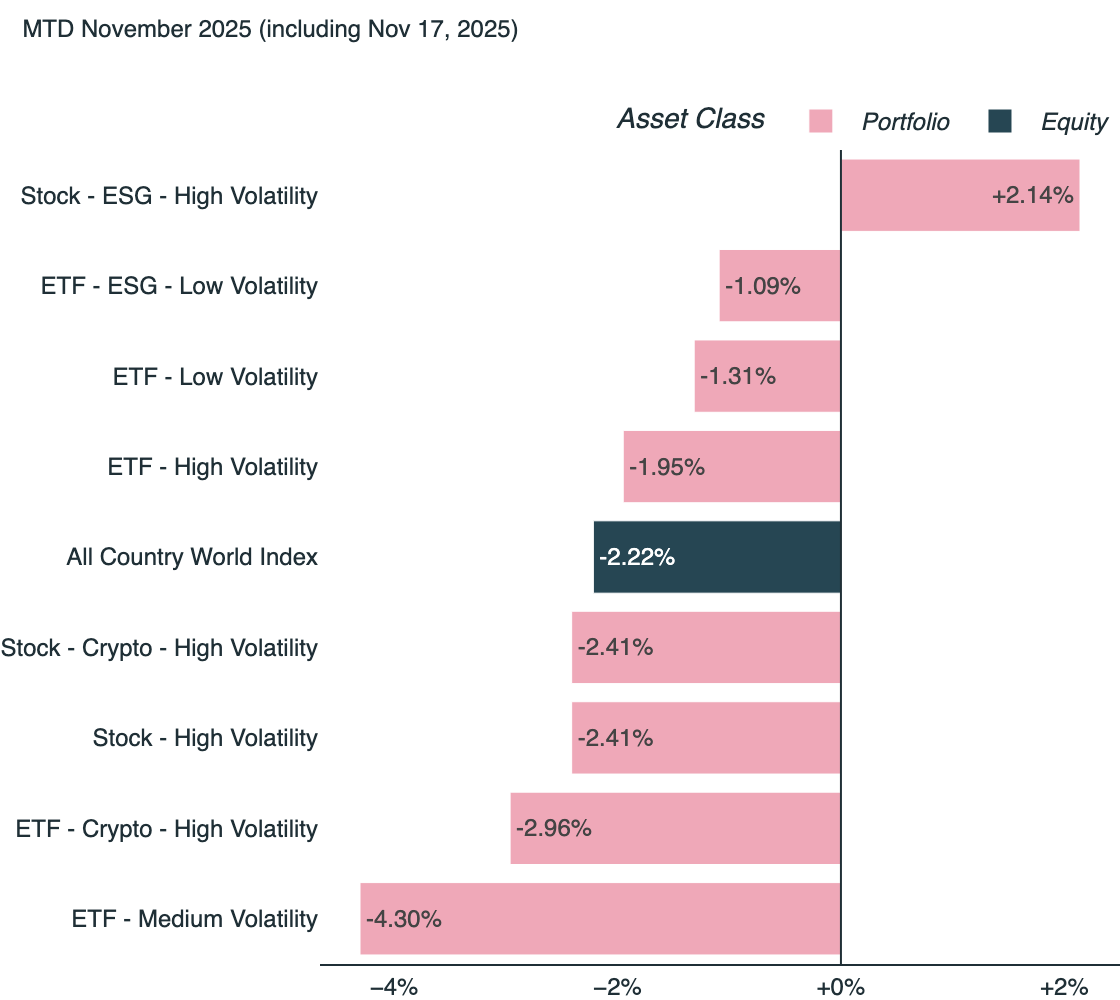

Portfolios

Reports the performance of the 8 pfolio portfolios and (if available) the user's portfolios. In addition, (if available) informs about a user's portfolio new allocations.

Pfolio portfolios

Reports the cumulative return over the relevant timeframe of the 8 pfolio portfolios against the All World Country Index (ACWI, iShares MSCI ACWI ETF).

My portfolios

Only for pfolio users that have built custom portfolios. Reports the cumulative return over the relevant timeframe of the user's portfolios against the All World Country Index (ACWI, iShares MSCI ACWI ETF). Caps the number of portfolios shown at 10, i.e. shows the user's top 10 portfolios.

Rebalancing

Only for pfolio users that have a portfolio saved as 'My Portfolio' (how to set My Portfolio). Shows the portfolio's new allocations.

Read our articles on rebalancing basics and rebalancing instructions for more information.

Disclaimer

Get started now